Have you re-ordered from your vendors lately?

- Joy Greenwood

- Feb 12, 2019

- 2 min read

Updated: Oct 13, 2025

By now, you've probably used some of the vendors I've provided in order to establish a D&B Paydex score, but have you re-used them lately? If not, you may not be getting the most bang for your buck. And worse yet, they may have already dropped off your report altogether.

Manually added payment history stays in your D&B report for 24-28 months, but history that flows in from auto-reporters can drop out of your report in half that time if you don't re-use the accounts at least once per year.

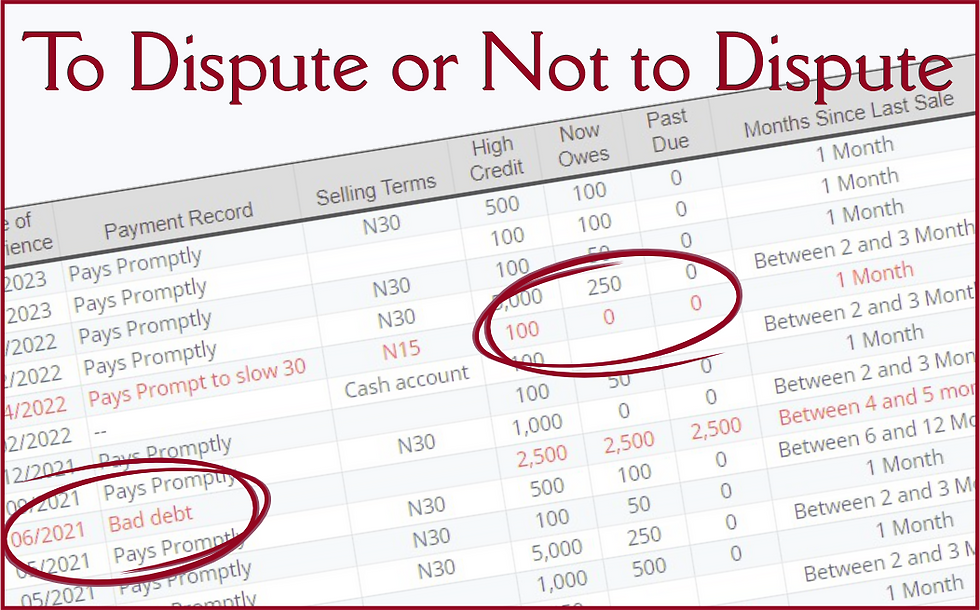

As you can see by the payment history shown below, I have an old $50 COD transaction that reported to my D&B file back in January of 2017.

Because that payment has reached its maturity (24 months) I can expect it to drop off my report soon. If I didn't have a sufficient number of vendors reporting to D&B, losing that one could have a negative impact on my Supplier Evaluation Risk rating. If that payment were larger and was also helping to prop up my Paydex or other scores, the result of losing it could affect my ability to achieve more credit.

Making a new purchase from your existing vendors once per year is good business, and for more reasons than you think. It helps to:

Keep your account open and in good standing

Provide an additional (bonus) boost to scores and ratings

Refresh old payments with new info for another two years

Prove your business is still active and functioning

Increase credit lines with your supplier over time

I track the payments in my file very carefully so I know who is reporting that payment. While I don't use them very often, I would like to keep the account open in case I need it again later — and since it's important for me to keep my D&B file in good standing — I know it's time to place a new order!

Keep in mind! — If you haven't ordered from one of your suppliers in a year or more, you'll need to meet the same minimum purchase requirements as you did in the beginning. Payments of less than $50 don't typically show up in the D&B report, so you'll need to keep that in mind. Some suppliers have even higher minimums, but those usually only pertain to the first order you place as a new customer.

Know who's reporting! — If you have payment history that is about to drop off your report, give me a call to see if we can identify which supplier you need to re-order from as soon as possible. If your payment has already dropped off the report due to age, just place a new order and check your report every week or so until you see the refreshed payment.

Comments