Who's on your vendor list?

- Joy Greenwood

- Jun 14, 2018

- 2 min read

Updated: Feb 4, 2022

Are you like Sam? Sam told me he didn't have any vendors. He said, "I don't have any credit. All I ever use are local guys and small businesses who have probably never even heard of D&B."

"Like who?" I taunted. "Just throw a few names at me to see what I can find."

While he sat in traffic, Sam started listing off some of his contractors and companies he'd worked with in the past year. In the fifteen minutes we were on the phone, I found all 7 of the companies in D&B's system. Over the next couple of days (and about an hour on the phone) we found 16 more... and then 4 more... and each and every one of them was just your average Joe-on-the-job.

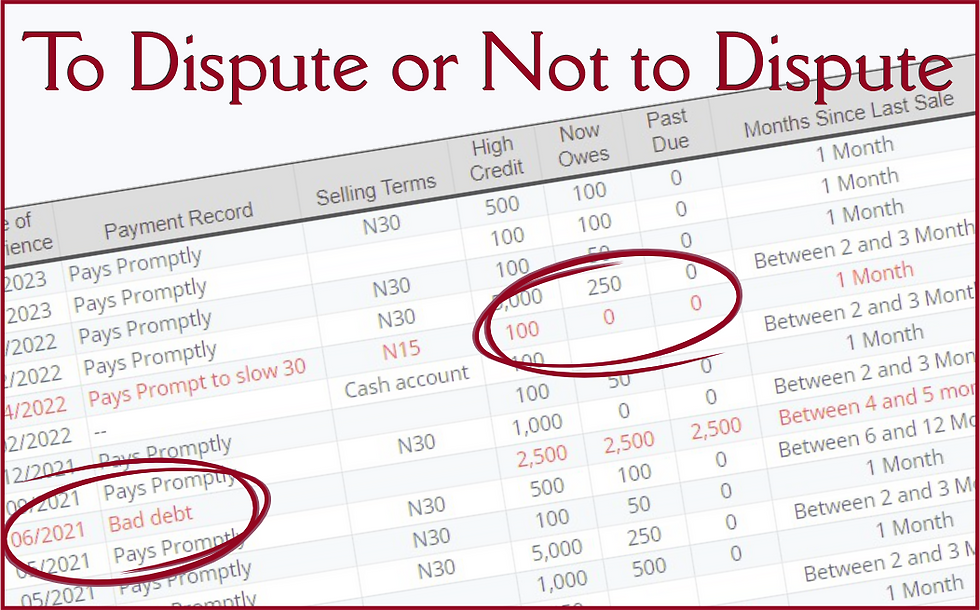

Originally, Sam had called me after seeing one of my blog posts on his Twitter feed. He said he had already fallen for a company who set him up with "the usual cookie-cutter credit" but none of the payments ever showed up in his D&B report. Instead, the only thing in his report was a slow payment from a telephone company. After reviewing his transactions with the vendors, it was easy to see why nothing was going his way.

Now, 28 days into the Powerboost process, Sam's got 12 payments showing on his D&B report — 9 net-terms (credit) accounts, and 3 COD's (prepaid) — and the slow payment has been removed. All of his scores and ratings are through the roof. He has opened new credit lines with 3 new vendors and has 2 new corporate credit cards.

All it cost him was my Powerboost fee ($99) and a month of D&B's Creditbuilder (about $150).

It may have taken me a few minutes to convince Sam to let me have a go at it, but in the end, he is super-satisfied with his progress and how fast it happened. He's going to stay with the program for another month to see what else we can get accomplished, but for right now, he's already convinced that doing things the right way is always going to work out better in the end.

So now I am asking you... Are you willing to "throw a few names at me to see what I can find"? If so, just:

Make a list of everyone you have spent money with at least once in the past 12 months

Sort through your receipts, credit card statements, checkbook, and payables file

If you have bookkeeping software, run a list of vendors used in the past 12 months

Search for each business on D&B's website

If your vendor comes up in D&B's search, they may qualify to report to D&B

Save time - send me your list and I will research it for you. I'll let you know who is most likely to qualify, and which will be the most beneficial to your business credit report.

Don't have the time to make a list? Do what Sam did and give me a call to see what we can get accomplished right over the phone - 800-918-7505 (ext 2). It's that easy, and it's free. Let me know if there is anything I can do to help.

Comments