Six Key Reasons DnB Doesn't Identify Creditors (and how you can!)

- Joy Greenwood

- Sep 20, 2017

- 3 min read

Updated: Feb 3, 2022

Have you ever wondered who is reporting payment history into your corporate credit report? Believe it or not, it's not always easy to tell. And, if it's a slow payment that's being reported, it can sometimes be very frustrating if you want to contact the creditor to clear up the problem.

There are two ways for payment history to find its way into the business credit report: either as an auto-reported transaction or through a manually uploaded vendor process.

AUTOMATICALLY - An automated process where vendors, suppliers, creditors and institutions link their bookkeeping systems to the business credit bureaus (D&B, Experian and Equifax) to report all transactions that meet or exceed a basic set of criteria, or —

MANUALLY - By submitting your vendors, suppliers and creditors via a paid service so the creditor can be contacted, transaction details gathered, and payment history placed manually into the report

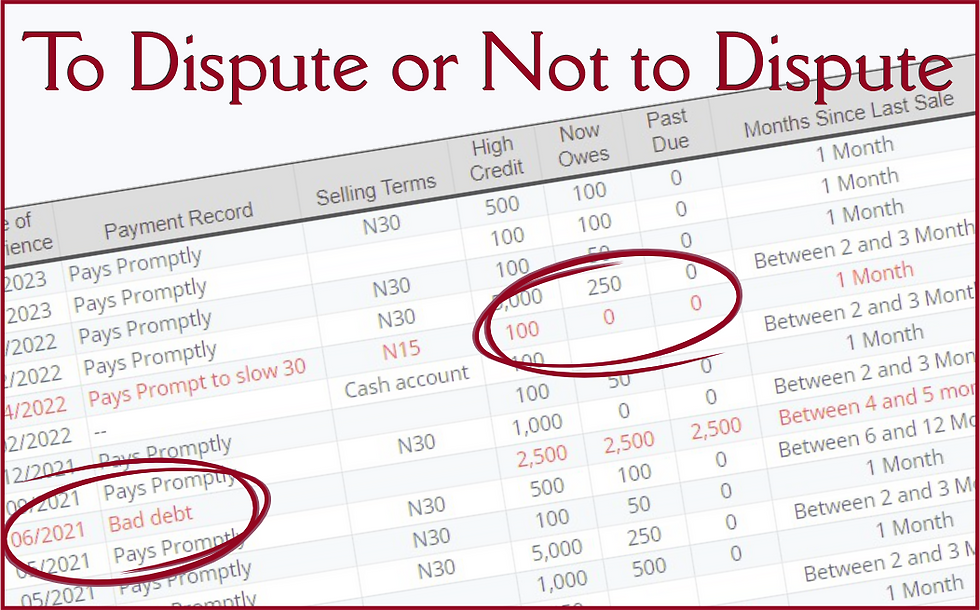

But there are some significant differences in the way those payments are going to reflect in the business credit file compared to what you see in your personal credit report... If you look at your personal credit report, you'll notice that you can instantly identify who is reporting your payment history, specifics about the account status, and (in most cases) contact information about the creditor. With business credit, however, you'll be afforded no such luxury. Instead of the company name showing in your corporate credit file, a generic industry identifier is used and the payment amount is rounded up or down (sometimes by thousands of dollars) to fit into predetermined algorithm parameters. D&B's practice of withholding or skewing creditor information has been challenged all the way to the Supreme Court. But, in the end, D&B has always prevailed, in part because they can mount some pretty tough arguments to support their overall objective: maintaining the sanctity of the proprietary data used to generate scores and ratings. Year's ago, while employed at D&B, I often found myself struggling to defend their "vendor anonymity requirement," especially when training new hires or consoling angry business owners. In fact, I developed the below list of talking points that is still being used today: Six Key Reasons D&B Doesn't Identify Creditors

To protect the identities of companies who have contractually agreed to provide purchasing information about their customers (Auto-reporters)

To keep auto-reporters from leveraging an advantage over other non-reporting businesses simply because they will report to the bureaus

To protect the privacy of the business owner with regards to their vendors and creditors, as well as the amount of the credit or expenditures with those creditors

To keep vindictive competitors from contacting an opponent's suppliers as a means to disparage the competition's reputation or credibility

To prohibit competing companies from pitting customer-against-customer or creditor-against-creditor, or demanding preference due to the reporting process

Protecting auto-reporters from a deluge of angry calls by pointing business owners toward a simplified slow payment dispute process

D&B is pretty strict in prohibiting their employees from releasing the names of the creditors reporting on your file, but there are, however, some pretty simple techniques you can use to identify those suppliers. Some are actually easier than others to identify, especially if you only use one of a specific type of supplier. Because companies are identified by their industry, you can look at the industry they are reporting under, the month of the most recent purchase, and the dollar amount of that purchase. For instance, if a company is reporting under the category of "Mfg computers" for $1000 and most recently reported in 08/20, you can look back in your bookkeeping records to see which major computer supplier you purchased from in July or August where you would have spent approximately $1000, and you'll probably find the supplier in your purchase history. Another technique you can use will focus on the size of the business reporting the transaction. In general, in order to auto-report to D&B on a regular basis, a company has to be reporting on a significant number of clients. Unless your local bookkeeper is affiliated with a major corporation, they are not likely to be an auto-reporter. You can also search for your suppliers on the Manta.com website to see what their specific SIC/NAICS codes are and how they are classified within D&B's database. If a supplier's SIC code has them designated as retailing office supplies, you will probably see them reported under Ret stationery or Ret office products. If you have a vendor or supplier that is reporting positive payment history in your D&B file, then you are already reaping the benefits of those transactions. If your suppliers are not reporting your payment history, give me a call to see if we can identify why and find a simple solution to resolve that issue. As always, reach out if you have any questions. Consultations are always free, and the advice you receive will always point in the direction of getting your business the credit it deserves.

Comments