WHAT ARE YOU MADE OF?

- Joy Greenwood

- Sep 23, 2016

- 5 min read

Updated: Feb 3, 2022

There's a old saying: The same boiling water that softens the potato hardens the egg. It's about what you're made of, not the circumstances.

Strong corporate credit works for your business, helping to prove you have accepted your role in the financial process. While some may huff and say "I don't need business credit" or "my business credit doesn't matter", a responsible business owner sees corporate credit scores and ratings as a tool that proactively impacts their company, employees, clients, and self.

America's most successful business owners and directors no longer have to rely on personal credit to fund their businesses. They have worked toward a corporate credit report that eventually — over time — takes on a life (somewhat) of its own, continuously re-building itself as it achieves milestones and rewarding itself with a vast open source of credit and contract opportunities borne out of each small successful step.

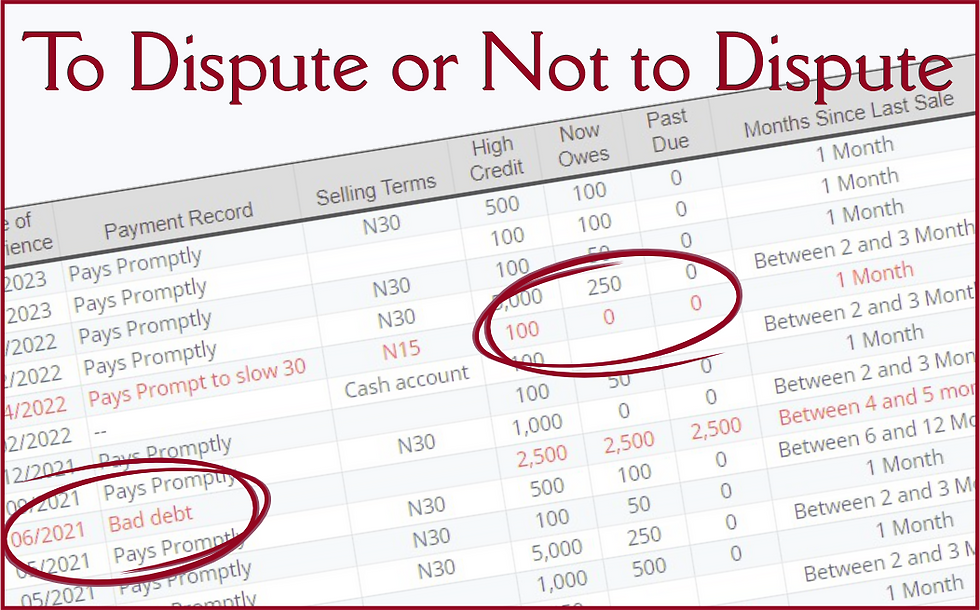

But even major corporations, big pharma, tech firms, and giant conglomerates still have work to maintain a strong credit file. Years ago, while employed by D&B, I helped many CEOs and CFOs of huge businesses organize and update their D&B files, get derogatory information removed, and add positive information. It's a part of the process no matter how big you get. But small business owner's can be even more harshly impacted and fail to grow due to a lack of scores and ratings.

It's about what you're made of, not the circumstances. If you have a business, you are already being impacted — one way or another — so you need to understand what is already being influenced by your file (or lack of one). Remember, data (or lack thereof) will say something about your business. You are the one who can determine what is being said and the reaction that conversation generates.

High credit scores translate to lower credit risk, so lenders look for strength and responsibility in the ratings that specifically reflect past payment performance. All business credit scores and ratings have payment history listed among the base seventy-five impacting factors, but the Paydex score and Supplier Evaluation Risk rating are the two most heavily impacted by past payment history. They are also the most easily influenced.

HERE'S HOW: If you don't have a Paydex score, it sends a message that you haven't been extended credit by anyone, not even the most basic of suppliers. If you have a poor Paydex score, it tells potential creditors you haven't paid your existing suppliers on time, so why would they want to extend credit? Among other things, the Supplier Evaluation Risk rating reflects the strength of your existing suppliers and your payment habits to those suppliers. On a scale of 1 to 9, a lower SER score means you have strong suppliers who have only good things to say about their interactions with your business. If you want to gain credit or contract approvals, you can improve these two scores by adding positive payment history to your file from a wider variety of suppliers.

Reliable data about your business helps to show strength and validity, which improves credit approval chances and generally supports higher credit approval amounts. When creditors and suppliers can match application data to the business credit report, they believe D&B has already verified the company and its supporting data as legitimate. When looking for legitimacy of a potential client, lenders and vendors look to the D&B Rating and D&B Viability Rating.

HERE'S HOW: If your D&B Rating is anything less than a full rating, it indicates your file is incomplete. Oftentimes, lenders and creditors will require that your business have any rating above a dash-dash (--). Without the barest of ratings, your application will either get declined or require a personal guaranty. The D&B Viability Rating defines the strength and viability of your company. Higher numbers and letters indicating lackluster payment habits and a young report that has no meat on it's bones. You can improve these scores by simply updating the data in your business credit file (which is free, and yes, simple).

Predictive indicators foresee the strength and functionality of a business as compared to its peers. If there is little or no "predictive" data (previous payment history) the Financial Stress Score and Delinquency Predictor Score will be based upon "descriptive" data, such as industry, age, employee count, and region. More value is placed on predictive data because it comes from a variety of sources and represents multiple payment types and histories, while descriptive data is usually only provided by the business owner or principal.

HERE'S HOW: While you can't change the age of your business, you can certainly make sure the data is correct in D&B's system. Since age and industry are two of the primary factors for both of these scores, it's important this information is accurate in your file. For instance, if you operated your business for several years as a sole-proprietorship before registering as an LLC, make sure D&B notes that in your file. Otherwise, your company may appear as young and inexperienced even though it has been active and functioning for several years. Injecting accurate information and payment history into your file helps to boost your company's creditworthiness.

Most creditors and lenders place preset base score criteria into their system so that only those who meet or exceed that base are auto-approved or given the best rates. If there is no business credit report, or if there is a neglected and incomplete report, a principal in the business may be required to personally guarantee the funding. Since the goal is to separate business and personal liabilities, the greatest benefit comes from a well-rounded and financially supportive credit file that proves your company is far stronger than your personal credit report would need to support.

Remember, most D&B files are sometimes created without the business owner's knowledge or consent. If you are not sure if you have a report, search for your company on D&B's website. If you have inaccurate or duplicate files, I can show you how to resolve most issues quickly and conveniently.

If you need help getting onto the right path, just ask. With many years experience working with D&B and D&B solutions, I'll give you straight answers to get you to your goals, no matter how big or small your business.

LESSON: Building your business credit isn't difficult, it is just a matter of projecting strength. It doesn't require over-priced services, deceptive tactics, risky short-cuts, or untested strategies, but —rather — steadfast determination and a single-minded focus toward one goal, corporate financial independence through a powerful corporate credit report.

Comments