4 STEPS TO STRONGER BUSINESS CREDIT

- Joy Greenwood

- Feb 16, 2016

- 3 min read

Updated: Jan 26, 2022

It’s a fact… Small business owners have to work harder to make their business a success.

Unlike the Fortune500, you don’t have the budget for contracting the best marketing company, or buying the best advertising spots, or hiring a ton of employees. You can’t put that responsibility in someone else’s hands. In many cases, you are the chief cook, bookkeeper, and bottle-washer, all rolled up into one. And, more often than not, you already don’t have enough hours in the day. Budgeting time to learn about, monitor, maintain, and build your business credit usually isn’t one of your top priorities.

Many small business owners fail to realize that building business credit is really not all that hard, it just takes a little time and energy and perseverance to get to the finish line. You may already have everything you need to succeed right at your fingertips.

1. Do you have an active and functioning business? 2. Do you have income and expenses? 3. Do you have a business credit report? 4. Have you paid for anything in the business name in the past?

If you answered “yes” to any of the above questions, you are already on the right path. So here are four steps you can take to help get you to the finish line without jumping through hoops…

COMPLETE YOUR BUSINESS CREDIT PROFILE • Get a free D-U-N-S number for your company • If you already have a D-U-N-S number, register to use D&B's update portal • Update all data to insure the most accurate report is being presented • Be sure to include all of the following:

• Company name • Any DBA’s or aliases • Company address • Company phone • Date business started • Total employee count • Annual sales • All principals & titles • Describe line of business

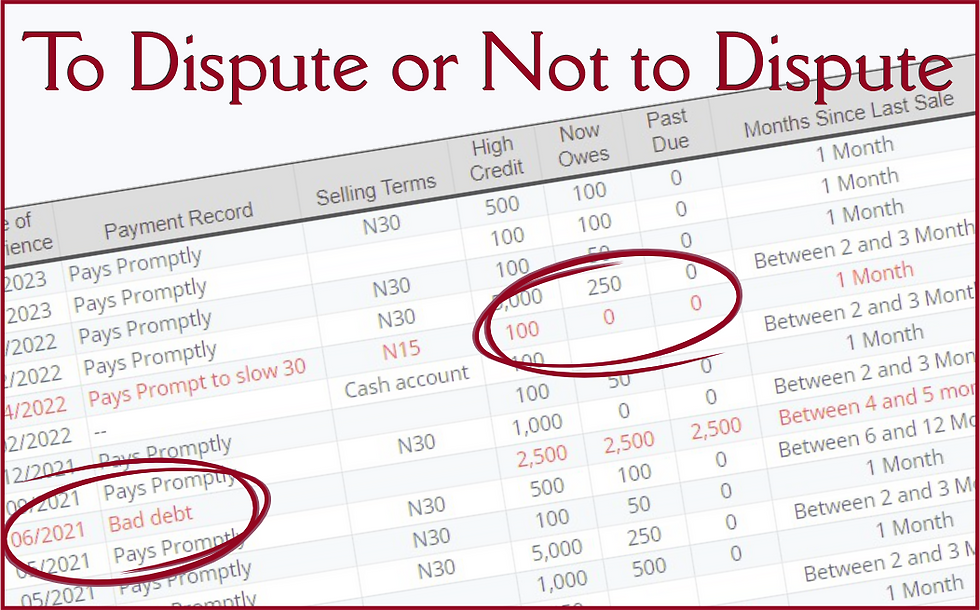

DISPUTE DEROGATORY INFORMATION FROM THE CREDIT REPORT • Log into D&B’s free DUNS Manager • Click on the tab for Payment Experiences • Choose any one payment that is reporting slow or past due • Check back periodically to make sure is is removed and that it stays off • Re-dispute slow payments up to 3 times • Incorrect payment history can only be removed, not corrected • Resolve old liens, suits, judgments and bankruptcies at the state level

BANK ON YOUR BUSINESS • Verify all billing, banking, and credit card information matches your D&B • Review bills from suppliers to insure company name and address is correct • Be sure to check that your bank account is listed to the business address • Pay all business expenses using business checks or debit cards • Check that the name and address on your company checks match to D&B Most credit card underwriters auto-report on their commercial customers. If you have a D&B file and the name and address match, the data should flow into your file automatically.

INSULATE YOUR SCORES BY STRATEGICALLY USING YOUR VENDORS • Try to use several vendors who will auto-report to Dun & Bradstreet • Spread purchases across a variety of suppliers and payment types • Work with suppliers and creditors to avoid using a personal guaranty • Be sure applications and accounts are created/contain exact company data • Ask vendors if they would be willing to report your payment history to D&B D&B offers a paid service to submit your creditors as trade references. An agent will call to gather payment history to be included into the file, which will boost scores and ratings.

LESSON: Sometimes, something as simple as changing your bill payment habits or updating the data in your D&B file can make a huge difference in your company's potential to succeed. Don't shy away from making the necessary adjustments if they mean you can boost your creditworthiness ten fold.

Comments