CREDIT REFERENCES

- Joy Greenwood

- Jun 12, 2014

- 5 min read

Updated: Jan 26, 2022

Your ability to establish new credit is dependent in large part to the historical data in your business credit profile. If there is no data being presented, D&B will generate scores and ratings based upon historical averages of other companies your size in your industry and in your area.

In order for your company to stand on its own merit, a strong business credit profile needs to be established which reflects a proven pattern of prompt payment and responsible management. This information can only be provided by companies who have extended credit to your business directly. This is done by reporting as a credit reference to D&B. The key to a perfect Paydex score is knowing how to get your credit references into your D&B profile, and which of those references will be most beneficial.

Think of a credit reference as a handshake introduction between your former creditors and your future lenders, vouching for your creditworthiness.

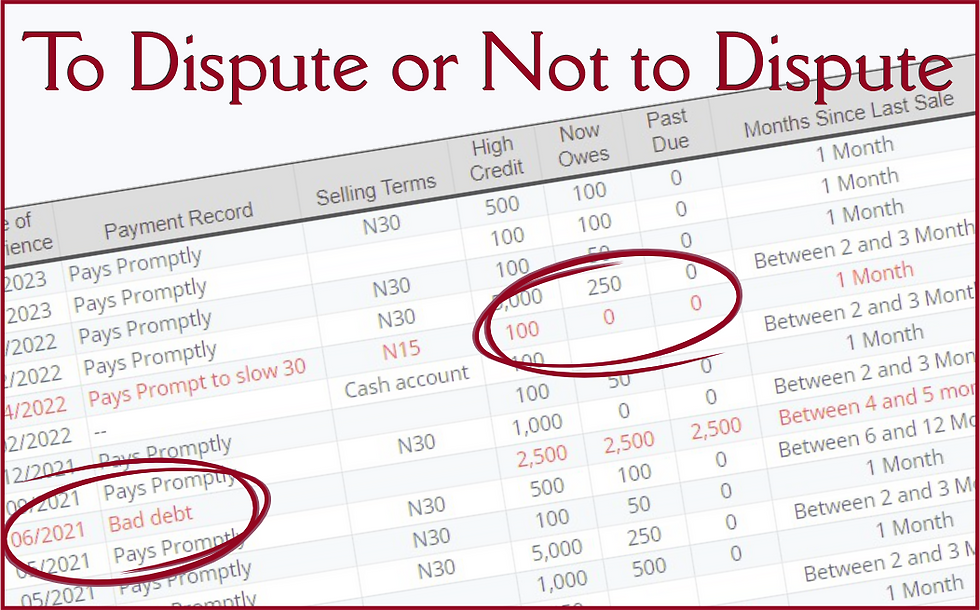

Trade references, otherwise known as vendors or suppliers, are companies who have extended you credit on terms — which means they have invoiced you for a product or service and have NOT required you to pay for the purchase before or at the time you took delivery. Basically, D&B is seeking information from the companies that have “trusted” you to pay them later, and how you repaid that trust. This payment history will either reflect positively when your vendor states “Sure! John always pays his bills on time!” or negatively if they say “John always pays his bills 5-10 days past the due date.” And it can be detrimental if the vendor says “I had to take John to collection and he still hasn’t paid that bill.”

D&B gathers this information, validates it’s source and then discloses the data to other companies who are considering offering John credit so they can either (a) be confident he will pay them on time, (b) take steps to make sure the bill will get paid on time, or (c) refuse to extend John any credit at all. D&B helps companies mitigate the risk by allowing lenders to see historical data from other’s experiences and decide for themselves. The more positive information you can get into your credit profile, the lower the risk. The presence of negative data, or in some cases an absence of any data at all, makes lenders leery and likely will stunt a company’s ability to grow and achieve more credit.

For those who are not well-versed in credit terms, here is a quick lesson:

CREDIT EXPERIENCES: (These are beneficial to boosting your credit profile.)

Net10: Bill must be paid in full within 10 days of purchase Net30: Bill must be paid in full within 30 days of purchase 2%10Net30: Get a 2% discount if paid in full within 10 days, but must be paid in full within 30 days Approx: Open-ended agreement that the bill will be paid in full when you get paid for a specific job

NON-CREDIT EXPERIENCES: (May help achieve a Paydex, but are not beneficial to your credit profile.)

Point-of-sale: Paid for at the register when you check out COD: Cash of delivery Cash: Paid at time of sale Prepaid: Paid when the order is placed, but before delivery of the product ACH: Payment arranged in advance as an auto-debit from your bank account or debit/credit card

Trade references can be added to your D&B profile in one of two ways, either as an auto-reporter to D&B or by being manually uploaded. Auto-reporting can only take place if your vendor is one of the hundreds of companies who provide all of their receivables data to D&B via an automated upload. D&B does not disclose who their auto-reporters are and, since their company names do not appear in your report, it is oftentimes impossible to determine who is auto-reporting on you. Auto-reporters can take up to 90 days to report your data to D&B and may have their own guidelines that will have to be met in insure your information will flow over. Manual upload of your vendor information can only be achieved by purchasing a paid D&B service.

Trade references can, quite literally, fall into thousands of different industries and categories, including sole proprietors, corporations, and LLCs — even some small businesses who are unaware they have a DUNS number — and there are thousands to choose from. There are approximately 200 million companies operating in the United States. Approximately 110 million of those are registered in the D&B database, but not all will qualify to be added to your D&B credit profile.

In fact, D&B has strict guidelines in place to insure that only qualified companies will be allowed to report your payment history. While D&B has pre-qualified their auto-reporting vendors, your manually submitted vendors and suppliers may face tough scrutiny. Many a business owner has thrown their hands up in frustration when trying to get their suppliers added to their report only to be told in the barest of terms, “Your vendor is not qualified.”

Be forewarned… Customer Service representatives are not permitted to tell you why a vendor has been declined. While there are about forty reasons why a vendor could be disqualified from being manually uploaded, only D&B knows the reason for the disqualification. In reality, the agent may be able to discern the reason for themselves simply by identifying what vendor was uploaded and seeing the same pattern in their calls time and again, day after day. Even so, agents are only permitted to say that the vendor likely falls into one of these categories:

The vendor is not a US-based company, or…

The vendor is a bank, credit card, financial institution, or utility, or…

The vendor does not have a full D&B credit profile of their own, or…

The vendor is among those who auto-report all transactions to D&B on a contractual basis.

“If I don’t know which of my suppliers will qualify, how do I choose who I can upload to my file?”

Generally, you will want to submit only those vendors or suppliers who:

• you paid promptly and not past the due date

• billed your company for a product or service

• your company has already paid the bill

• are a vendor who has a D&B report of their own

• are reachable using the phone number D&B has on file

• agree to take D&B's call to verify your payment history

• report transactions that meet D&B standards

Back when we first started our company, we contacted several companies and asked whether they do (or would) report to D&B, so we may also be able to help pre-qualify or -disqualify vendors, saving you the wasted time (and money). While it is impossible for anyone outside of D&B to know every specific reason why a given company doesn’t qualify, we can sometimes identify known issues in advance.

Some business owners have yet to separate their business and personal credit, so most (if not all) of their payment experiences have been associated to their individual credit. We can sometimes help get those accounts converted to business accounts and, as I stated earlier, can also help you to establish new retail credit accounts in your company name.

LESSON: Invest time and energy into which of your trade references you will be submitting to D&B. Once you reach the point of applying for more credit, use those creditors report those positive payment habits to D&B, as well. That way, the circle of growth and credit achievement can continue for years into the future.

Comments